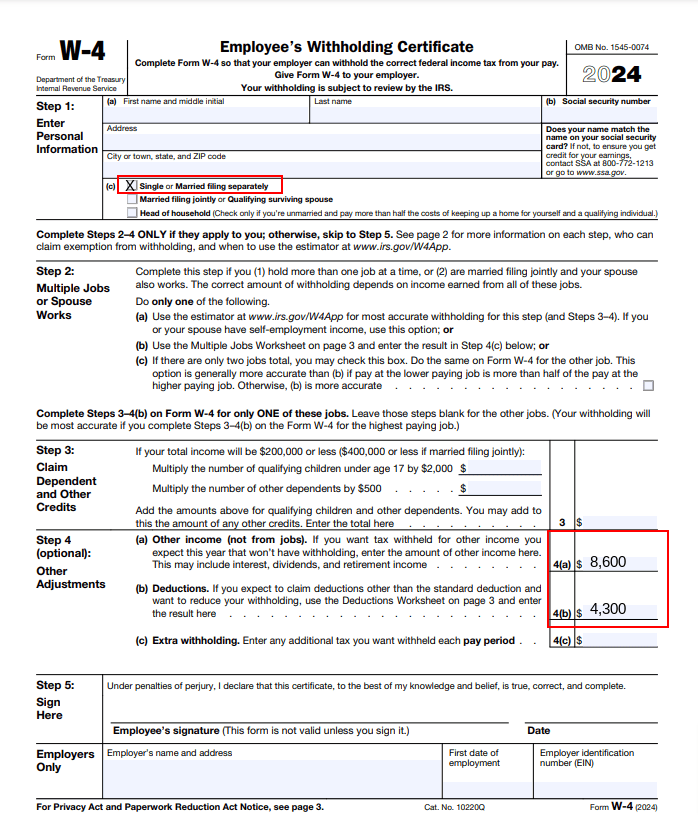

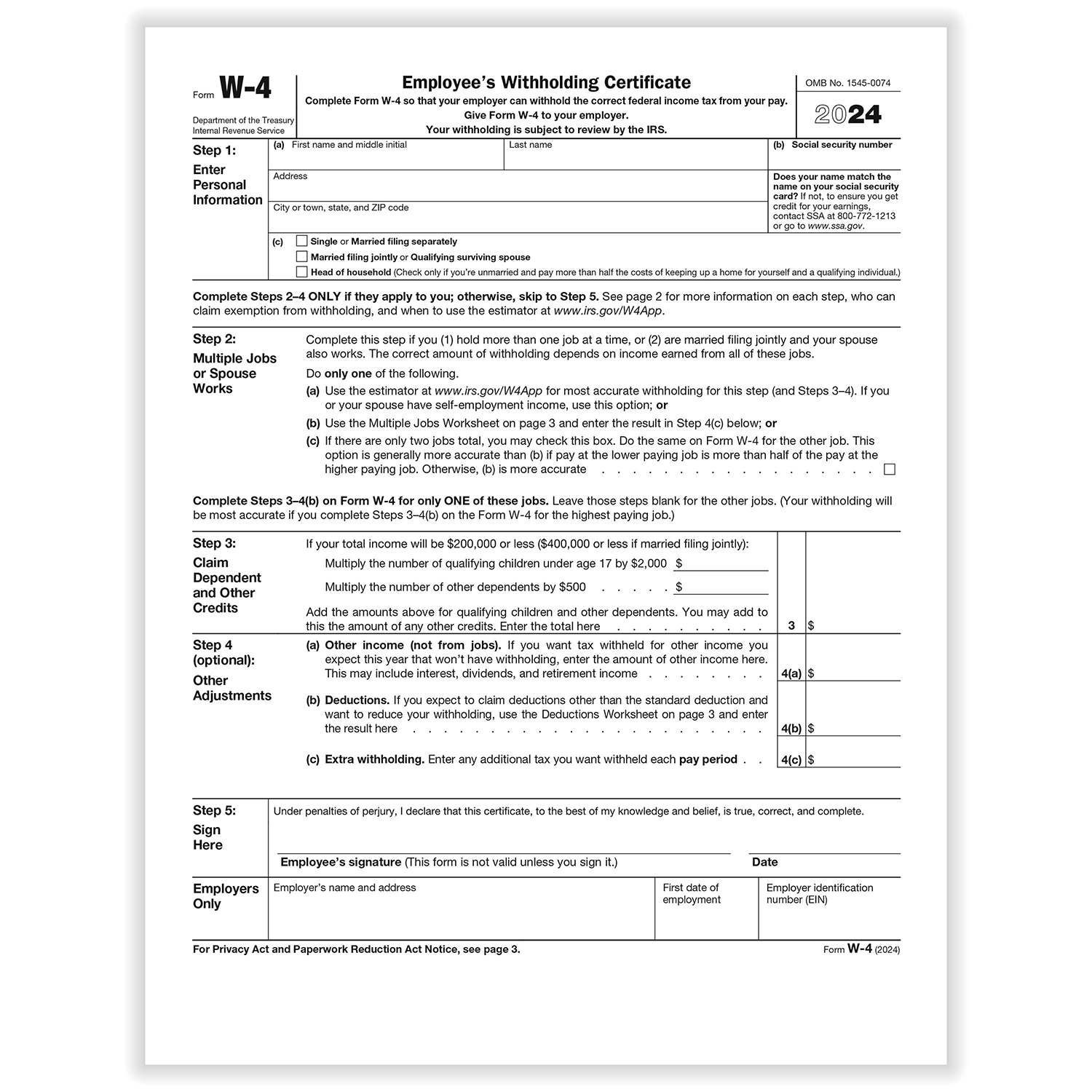

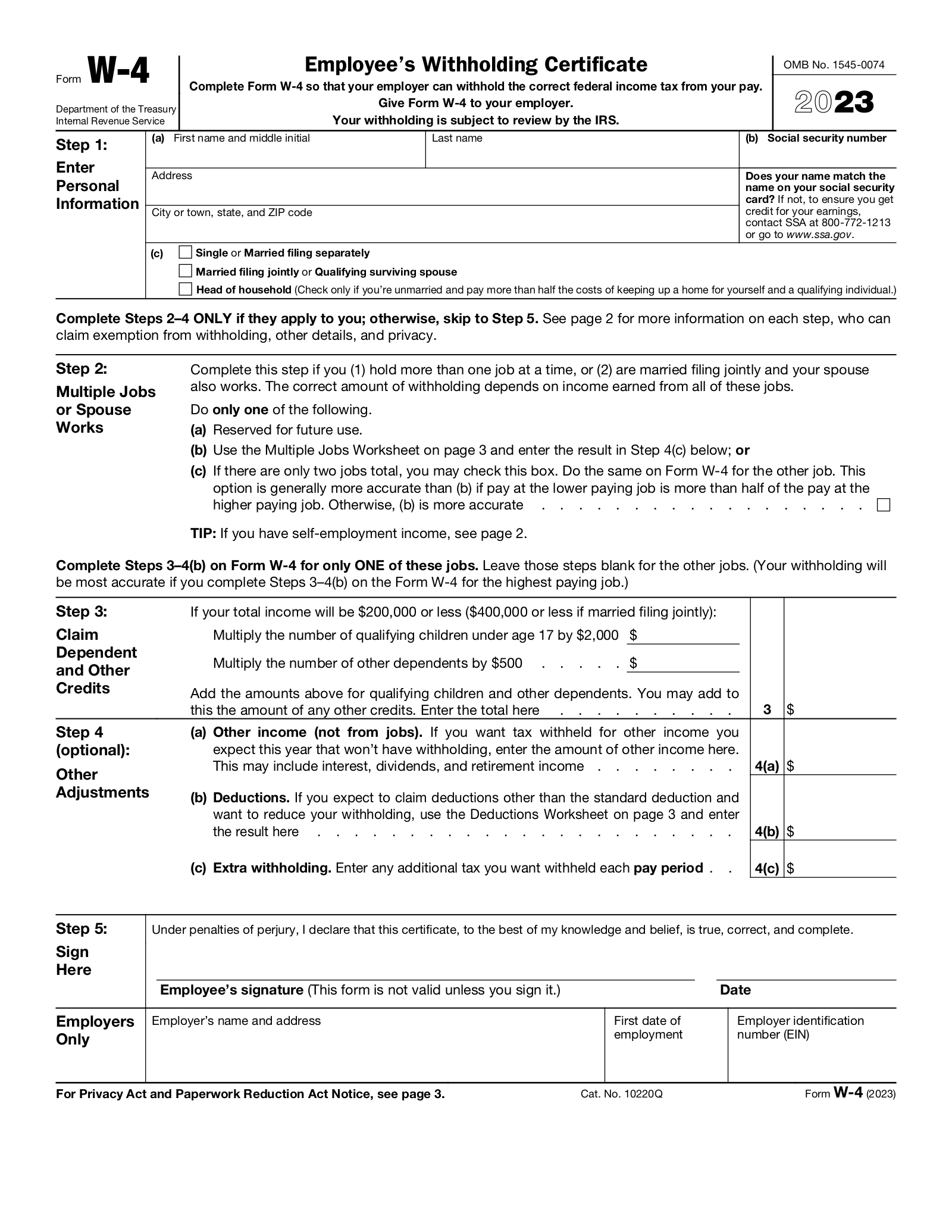

New W4 2024 – Experts warn that last year’s tax withholding errors could trigger an unexpected bill. Here are some of the most common issues, according to tax pros. . If your tax refund or bill is higher than expected, it may be time to adjust your paycheck withholding. Here’s how to know if you’re withholding enough. .

New W4 2024

Source : www.irs.govW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com2024 New Federal W 4 Form | What to Know About the W 4 Form

Source : www.patriotsoftware.com2024 IRS W 4 Form | HRdirect

Source : www.hrdirect.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comFree IRS Form W4 (2024) PDF – eForms

Source : eforms.com2024 Form W 4P

Source : www.irs.govHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comNew W4 2024 Employee’s Withholding Certificate: To avoid this, be sure to submit a new W-4 as soon as your raise kicks in. You received additional income that wasn’t subject to withholding Another common reason you might owe taxes — even if . States have long grappled with the question of how to properly source the income of an employee who works at home in one state, for an employer in another state. In response to the tax burden placed .

]]>